Target

Target- IL-4Rα

Generic Name

Generic Name- Recombinant humanized anti IL-4Rα monoclonal antibody injection

Potential Indication

Potential Indication- moderate-to-severeAD PN CRSwNP CSU moderate-to-severe asthma COPD adolescent AD

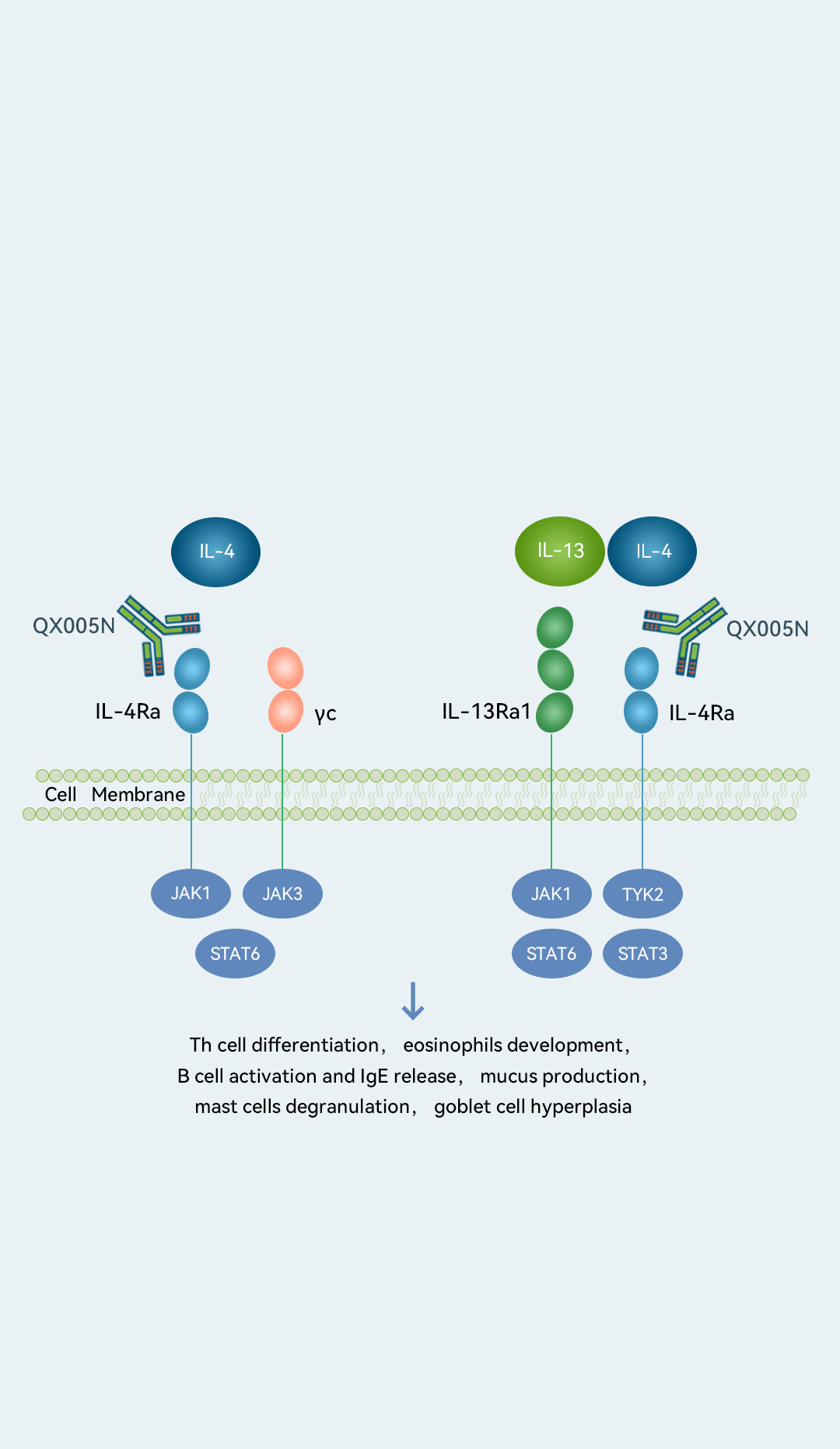

Our other Core Product, QX005N, is designed to inhibit IL-4Rα, a well-validated,broad-acting target for a wide range of indications. Because IL-4Rα controls the signaling of both IL-4 and IL-13, which is critical in the initiation of type 2 inflammation, it has emerged as a key target for new drug development in related indications.

As of March 2023, we had obtained IND approval for QX005N for five indications (namely, atopic dermatitis, prurigo nodularis, chronic rhinosinusitis with nasal polyps, chronic spontaneous urticaria and asthma), one of the most among IL-4Rα targeting drug candidates in China. QX005N demonstrated favorable safety and efficacy results in our Phase Ia and Phase Ib clinical trials for AD. In the Phase Ib clinical trial in patients with moderate-to-severe AD, in each of the 300 mg and 600 mg groups, 75.0% of subjects achieved EASI-75 responses and 50.0% of subjects reached IGA scores (0 or 1) at week 12 without significantly increased safety risks. We have started a Phase II clinical trial for AD and completed patient enrollment in February 2023. In addition, we commenced a Phase II clinical trial for PN in February 2023. According to Frost & Sullivan, QX005N was the first biologic drug candidate developed by a Chinese domestic company to start a clinical trial for PN in China. We also plan to commence a Phase II clinical trial of QX005N for CRSwNP in the second quarter of 2023.

The industry landscapes of the indications in China are as follows:

Atopic dermatitis (AD). According to Frost & Sullivan, the prevalence of AD in China was 68.9 million in 2021, and is expected to reach 81.3 million in 2030. The AD drug market in China was US$0.8 billion in 2021, and is estimated to grow rapidly to reach US$7.2 billion in 2030, at a CAGR of 27.5%.

Prurigo Nodularis (PN). According to Frost & Sullivan, the prevalence of PN in China was 1.9 million in 2021, and is estimated to reach 2.1 million in 2030. Development of the PN drug market in China is still at an early stage with no biologic drug approved as of the March 2023.

Chronic Rhinosinusitis with Nasal Polyps (CRSwNP). According to Frost & Sullivan, the prevalence of CRSwNP in China was 20.1 million in 2021, and is estimated to reach 23.1 million in 2030. The CRSwNP drug market in China was US$130.6 million in 2021, and is expected to reach US$622.3 million in 2030, at a CAGR of 18.9%. As of the March 2023,no biologic drug had been approved for the treatment of CRSwNP in China.